All Categories

Featured

Table of Contents

It permits you to budget plan and strategy for the future. You can easily factor your life insurance right into your budget plan since the premiums never ever transform. You can intend for the future simply as quickly because you know precisely just how much cash your liked ones will obtain in case of your lack.

In these situations, you'll usually have to go with a brand-new application procedure to obtain a much better price. If you still need protection by the time your level term life policy nears the expiry date, you have a couple of alternatives.

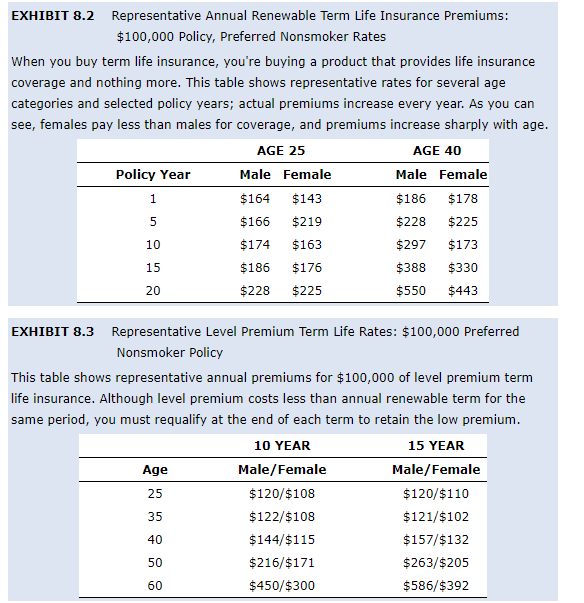

The majority of level term life insurance policies come with the option to renew insurance coverage on a yearly basis after the initial term ends. a renewable term life insurance policy can be renewed. The price of your plan will certainly be based upon your present age and it'll enhance yearly. This can be a good choice if you only require to prolong your protection for 1 or 2 years otherwise, it can obtain pricey quite rapidly

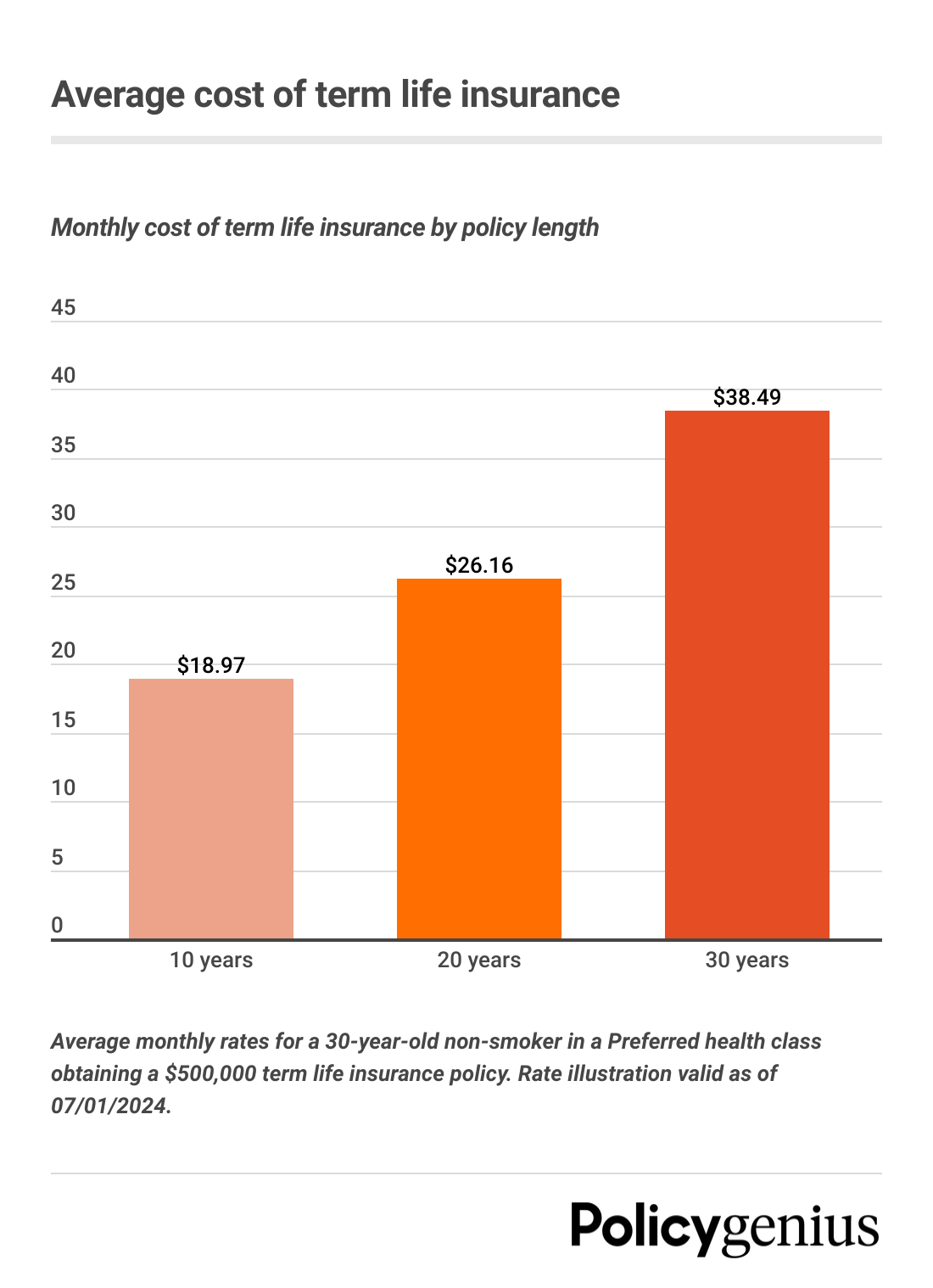

Degree term life insurance is just one of the cheapest coverage options on the marketplace since it provides standard security in the kind of death benefit and only lasts for a collection period of time. At the end of the term, it ends. Whole life insurance policy, on the other hand, is considerably extra pricey than level term life because it doesn't expire and includes a cash money value attribute.

Cost-Effective What Is Decreasing Term Life Insurance

Rates may differ by insurance company, term, insurance coverage amount, health course, and state. Not all plans are offered in all states. Price image legitimate as of 10/01/2024. Degree term is an excellent life insurance policy option for lots of people, but relying on your coverage demands and individual circumstance, it could not be the very best suitable for you.

Yearly sustainable term life insurance policy has a regard to only one year and can be renewed yearly. Annual renewable term life costs are originally lower than level term life premiums, yet costs go up each time you restore. This can be an excellent option if you, for instance, have simply stop smoking cigarettes and require to wait two or three years to make an application for a level term plan and be qualified for a lower rate.

Comprehensive Short Term Life Insurance

With a reducing term life plan, your fatality benefit payment will reduce in time, but your repayments will certainly remain the same. Reducing term life policies like home loan security insurance coverage generally pay out to your lending institution, so if you're trying to find a plan that will certainly pay to your loved ones, this is not a great suitable for you.

Enhancing term life insurance policy plans can assist you hedge versus rising cost of living or strategy monetarily for future kids. On the various other hand, you'll pay even more ahead of time for less protection with an increasing term life policy than with a degree term life plan. If you're unsure which type of plan is best for you, working with an independent broker can assist.

When you've chosen that degree term is best for you, the next action is to purchase your policy. Right here's how to do it. Compute just how much life insurance policy you require Your insurance coverage amount ought to provide for your household's long-term monetary needs, including the loss of your earnings in case of your fatality, in addition to financial obligations and day-to-day expenditures.

A degree costs term life insurance policy strategy allows you adhere to your budget plan while you assist protect your family. Unlike some tipped price plans that raises annually with your age, this sort of term plan offers prices that stay the exact same for the duration you pick, also as you get older or your wellness adjustments.

Find out more concerning the Life Insurance coverage options offered to you as an AICPA member. ___ Aon Insurance Solutions is the trademark name for the brokerage firm and program administration procedures of Affinity Insurance coverage Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Solutions Inc.; in CA, Aon Affinity Insurance Policy Solutions, Inc.

Exceptional A Term Life Insurance Policy Matures

The Plan Agent of the AICPA Insurance Coverage Trust, Aon Insurance Policy Solutions, is not connected with Prudential. Group Insurance policy insurance coverage is issued by The Prudential Insurance Provider of America, a Prudential Financial firm, Newark, NJ. 1043476-00002-00.

Latest Posts

Final Expense Risk Insurance

Funeral Policy For Over 80 Years

American Benefits Final Expense